Face Your Fear: How to Start a Blog and Make Money

Just as with any new career, starting a blog can seem like a scary (and sometimes impossible) task. A significant difference between a blog and a typical job, though, is your income potential. A blog can give you the ability to make unlimited amounts of money, so consider that when you think of how nervous you are to put yourself out there. The payoff is usually worth it. Knowing that it’s time to face that fear, learn how to start a blog, and make some money.

Related post: Don't Let Your Fear of Starting a Business Stop You

Choose a Niche

A blog niche is fundamental. A niche is essentially a category your blog will fall into. For example, this blog is all about finance related to moms. Other blogs talk about fashion, lifestyle choices, and specific career tracks. While most people have a topic in mind when they start their blog, some have no idea. If you’re in the second category, you should choose a niche that you are passionate about.

While appealing to a broader audience may ...

Don't Let Your Fear of Starting a Business Stop You

Do you remember when you first became a mom? I remember it like it was yesterday. I had so many fears. I was afraid that I wouldn't be a good mom. I was worried that my kids would get hurt. Sometimes I'm afraid I will say the wrong thing when we have an important conversation.

It's normal to worry when you embark on something new, and starting a business is no different. Fear of starting a business is entirely normal. As a business owner, I am constantly pushing myself outside my comfort zone to grow and make a more significant impact. With that said, it's also incredibly rewarding to see the business that I've built.

When I talk to those who are interested in starting their own business, but they can't seem to take the plunge, I find that it's often self-belief that is holding them back. If you suffer from a lack of self-belief, all hope is not lost!

Overcome your fear of starting a business with the following tips:

Set a Goal and Create a Plan

The mere act of setting a goal (o...

3 Tips to Overcoming Money Fears

What is your biggest fear? Ask a child and they may respond that it's spiders or snakes or some other creepy-crawly. However, as we grow older, we begin to realize that there are other kinds of things to fear. For example, fear of losing a job or fear of not being able to pay the mortgage.

The consequences of the things we fear can seem unbearable. Money fears are no different. So, what do most people do? Lie and hide. That's right. I said they lie and they hide. They lie to themselves about how serious things are, and they hide their fears or their consequences from others.

Some of these may be the very people who could help, but fear and shame keep them from admitting they are in trouble.

Honesty feels risky

Getting honest about money when you are in trouble feels risky. In some cases, it can cause harm, and in others, it can create worse case scenarios. From missing a payment and having an adverse credit score to causing financial damage to a business or institution, money pro...

The Best Frugal Halloween Finger Foods to Fit Your Party Budget

Entertaining for Halloween can be fun, but between the costumes, the spooky decorations, and the candy for all of your neighbors’ kids, the cost can add up quickly! Save some money this year with these frugal Halloween finger foods. Bonus: because they are finger foods, you won’t need to provide all of those plastic utensils. See, we are saving money already!

“Finger” Food

Serve your guests hot dogs with a few notches cut out of them for a literal take on frugal Halloween finger foods. Hot dogs are inexpensive, kid-friendly food, and easy to serve. To turn your average hot dogs into fingers, cut a small square out of the top portion of the hot dog for a nailbed look. Cut three lines underneath that and three more about halfway down the hot dog. Serve the hotdogs with some ketchup on them for a bloody look.

Web Pizza

Pizza is a fan favorite and is so affordable when you make it yourself. Purchase premade dough and coat it in pizza sauce. Then, arrange your white cheese in a spide...

20 Cheap Non-Candy Halloween Treats

Halloween will be here in no time. With three children, the amount of candy that comes into our home is ridiculous. I don't like to give me kids a lot of candy anyway. They act like different people when they're hyped up on sugar and not in a good way. I usually end up donating some of it and throwing out what remains in December since they bring home a ton of candy around Christmas, too. That seems like a huge waste of money to me.

I've noticed more and more of my neighbors handing out non-candy items for trick-or-treating, and I really appreciate it. The juice boxes, granola bars, and pretzels never go to waste in our house. One of our neighbors even does little stuffed animals or glow sticks, and my kids are always really excited to get those.

Related posts:

One my Favorite DIY Halloween Decorations

Our Favorite Budget-Friendly Halloween Costume Tips

If you are seeking non-candy alternatives that won't diminish the Halloween fun, here are some...

8 Fall Festival Games That Won't Break the Bank

Every year our elementary school PTA puts on a fantastic Fall Festival and every year we are trying to coming up with new ideas on a shoestring budget. We have been very fortunate that one of the parents always donates his DJ services so we always have great music.

Here are some of my favorite activities that we've done in recent years.

Fall Festival Games

Pumpkin Bowling with Ghost Pins

Collect empty 2-liter bottles to use as pins and get some small to medium-size pumpkins to use as bowling balls. You'll need 8-12 bottles. If you want to make the game extra cute, spray paint the bottles white to make them look like ghosts. After they dry, use a permanent marker to draw eyes and mouths.

Set the bottles up like bowling pins and use the pumpkins to try and knock them down.

Donuts on a String

Kids can't get enough of this one and it's fun to watch, too. That's my daughter in the picture above. Hard to believe she used to be that little when she will probably be taller than me by ...

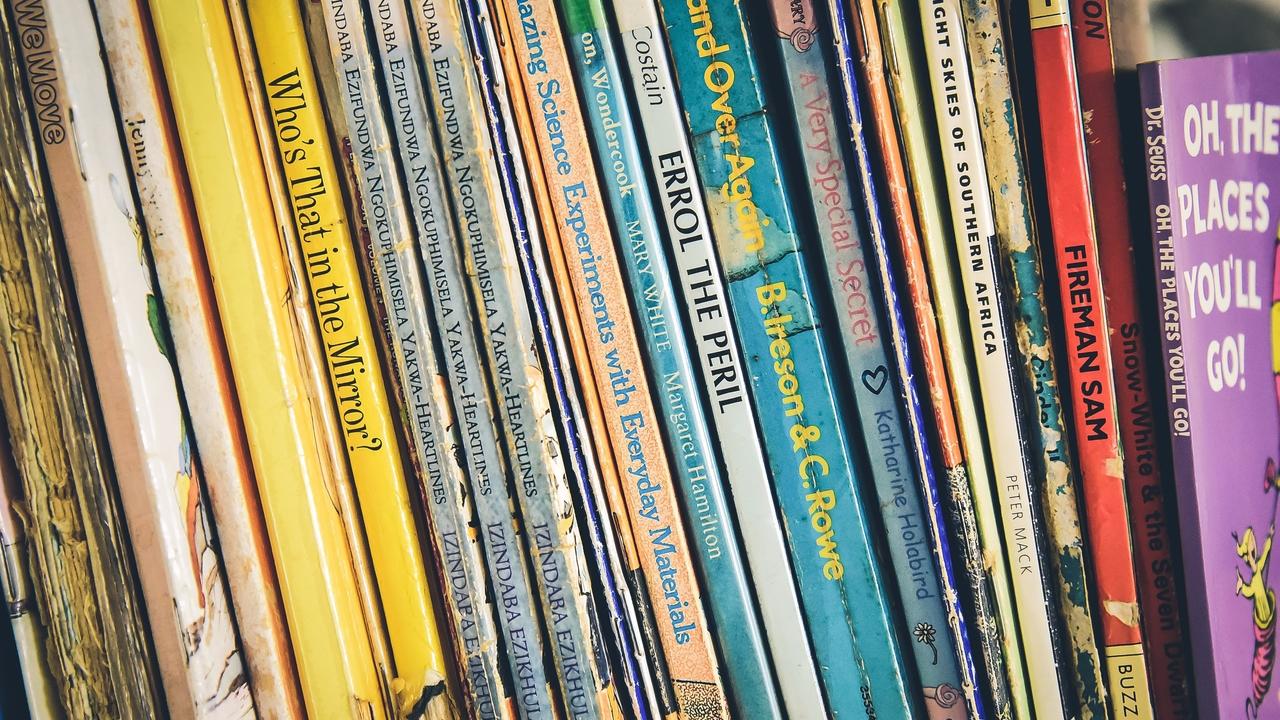

Budget-Friendly Book Character Costumes for Teachers

As a teacher, dressing up for Halloween can be difficult. It’s hard to find a costume that’s not racy, scary, or could potentially offend someone. A safe choice for teachers is usually a book character, but you’ve been Hermoine the past four years and it’s expensive to dress up like a bus, Miss Frizzle. Instead, use these budget-friendly book character costumes for teachers as inspiration!

Related post: Our Favorite Budget-Friendly Halloween Costume Tips

The Rainbow Fish

This is one of the best budget-friendly book character costumes for teachers and you can even whip it up the night before! Make your own multi-colored tutu for the rainbow part. Tulle is inexpensive and making your own tutu couldn’t get easier.

You’ll also need a blue shirt and some felt to create scales on your shirt. You can sew the scales on or use hot glue to keep them in place. All in, the project should only set you back a few dollars!

Make sure to grab a copy of this iconic book and pick it up to read t...

9 Cheap Halloween Party Ideas

The spooky season is finally here! Get ready to bump into Halloween décor in almost every store you visit. From food ideas, Halloween-themed décor to various crafts, it can be difficult to stay on track with your budget and yet still enjoy the season. Check out these 9 inexpensive Halloween party ideas that can be created (or purchased) without breaking your budget.

Related posts:

One my Favorite DIY Halloween Decorations

20 Cheap Non-Candy Halloween Treats

Our Favorite Budget-Friendly Halloween Costume Tips

1. Turn Your Toilet Paper Rolls into Bats.

Turning your empty toilet paper rolls into bats is arguably one of the easiest Halloween DIY’s you’ll ever try. Just collect a couple of rolls and paint them black. From that point on – it’s all about your creativity. You can add paper wings and googly eyes, or simply use whatever other materials you have lying around the home. Make a “bat family” or add it as an activity for your Halloween party. After all, who doesn’t love repurpo...

One of my Favorite DIY Halloween Decorations

It's easy to spend a small fortune on decorations for holidays. However, between Halloween costumes and pumpkins, going all out on decorations might be outside your budget. You can still have fun without spending a lot. One of my favorites to make is a homemade scarecrow.

I think the scarecrow has got to be the most common DIY Halloween Decoration. I've been making them since I was a kid. AND, it's a great way to get the kids to rake and think it's fun. Not only that, you can do it with materials lying around your house.

Related posts:

20 Cheap Non-Candy Halloween Treats

Our Favorite Budget-Friendly Halloween Costume Tips

There are lots of different versions of scarecrows. Encourage your kids to get creative with the materials. Here's one version.

Related post: 50 Ideas for Free Family Fun This Fall

Materials:

- Old button-down shirt

- Old jeans

- Pair of old pantyhose

- String (or twine)

- Leaves (or straw)

- Lawnchair

- Milk jug (to make the head) - ...

Our Favorite Budget-Friendly Halloween Costume Tips

My kids love Halloween. More than the candy, they thrive on having the opportunity to wear their “dress-up” clothes out of the home. There’s nothing quite like pretending to be someone you idolize. Unfortunately, the budget doesn’t always accommodate the expensive costumes they’d prefer, which is why I’m always searching for new, inexpensive ideas. A single post on Facebook netted a bunch, so I thought I’d share a few with you.

#1: Gum Stuck to Shoe

If you have a pink shirt (and possibly pink pants as well) this is an easy costume to put together. Just attach the bottom of a shoe to the top of your head and you are immediately transformed into the gum stuck to the bottom of a shoe. While your costume will be more identifiable with pink “gum”, you may want to mix it up and go as a wintergreen version.

#2: A Ghost

Have an old white sheet lying around? Place it over the head, cut two holes for eyes and ta-da! You are a ghost.

If you have a white outfit, you can step up your ghost ga...