Understand How Your Money Can Work for You

With the Fund Your Freedom Money Bundle, you will learn how to manage your money well so you can fund your way to financial freedom!

Fund Your Freedom is a digital bundle to help you learn how to stop being broke, master your spending, and fund your way to financial freedom.

Fund Your Freedom includes a fully-loaded financial hub, money workbook, bill tracker, spending plan, and video lessons teaching you my signature MoneyWise Blueprint™ to help you take back control of your finances so it can stop controlling you.

What's the biggest difference between people who have financial freedom

...and people who anxiously login to their banking account to see if they can even afford to pay their bills?

If you guessed it's because they have more money to budget, you're incorrect.

If you guessed it’s because they have a degree in finance, you’re incorrect.

If you guessed it’s because they take their lunch to work more often, read more books on personal finance, or are more successful at “no spend months,” you’re still incorrect.

Because while some people can attribute being financially free to these things, they are not the most common denominator.

The common denominator is a financial strategy. You need a strategy in place to help you achieve financial freedom, or you'll find yourself in a never-ending cycle of 0% balance transfers, a plummeting credit score, and a creeping sense of failure that accompanies the lie that maybe you're just not good with money and will never experience financial freedom.

THE PROBLEM:

You've reached a cash-flow crisis

AND ARE COMPLETELY STRESSED ABOUT IT

Maybe this has happened to you.

And maybe more than once.

It doesn’t get any less mortifying each time it happens. But there you are: it’s your first free Friday night in a month. With an unexpected night off and your kids at their dad’s house - you welcome the spontaneous invitation from your group of friends

to go out for drinks.

You deserve it! You work so hard! You’ve been through a lot lately! (All true, you can’t argue).

You clink your drinks together and the evening passes with savory hors d'oeuvres and belly laughs that make your cheeks hurt. And it’s all sangria and happiness until the waiter lays that black leather clipboard with your total in front of you.

In a couple of seconds, your anxiety heightens as you attempt to file through the flimsy budget in your head; have you paid the water bill yet this month? Was your cellphone bill automatically deducted yet? Your mental math is futile.

With cold sweaty fingers, you slide your debit card into the payment holster.

The waiter whisks all your cards away and you whip out your phone to peek at your checking account balance. You login and the actual numbers don’t even register, all you see is red. You quickly close the app and hope your friends weren’t peeking over your shoulder.

The waiter comes back to the table and tried to quietly mutter "there was an issue with your card..." but you already know there's not enough

money in your bank account.

You gather all the anxiety in your body and clench it together in your gut to keep from audibly wavering your voice “sorry about that - try this card” as you hand the man your credit card instead -- knowing full well you have *no idea* when you’ll be able to pay it off OR bring your checking account back to positive integers.

And this just keeps happening! Tonight it was out with friends, but next week it might be in the grocery line at the store or when it’s YOUR turn to buy coffee at work.

It doesn’t make any sense; you feel like you’ve got so much going for you - so much figured out, but you’re horrified at the fact that you can’t seem to make that translate into having your crap together financially.

It feels like you have no control over what happens to your money. You get paid and one week later, it’s basically gone.

And this is how it goes. Every night out, every Starbucks coffee, every Target shopping trip, every experience feels tainted by the anxiety of overwhelming debt and the feeling that you’re never going to be able to get on top of it.

The secret to being good at money

LET'S BE REAL:

YOU'RE NOT

ASKING FOR

A MILLION

DOLLARS HERE.

You just want to be able to sleep at night (or go out with friends) and KNOW...

Without a shadow of a doubt that your money is working for you - that your bills are being paid, that your savings account is growing, and that your financial goals are coming true paycheck-by-paycheck (instead of living paycheck-to-paycheck).

With the amount of time, professional experience (including your salary), and energy you’ve poured into trying to get out of debt -- you should be able to master your money no problem.

Taking the kids to Disney could be an easily-affordable annual vacation, nights out with friends should be relaxing, not anxiety-inducing. And peeping your checking account throughout the day should bring waves of excitement over the number you see in there and how fast it grows, not shame at how quickly it dwindles.

So what if there was a way to finally feel like you had a handle on your finances?

Because that’s exactly why I’ve created the Fund Your Freedom Money Bundle.

I want you to know that YOU control your money (and not the other way around).

I want you to finally understand where your money goes and keep it from disappearing so fast.

I want you to feel empowered with the freedom of choice that money can give you, and not the feeling of being trapped that comes being out of control.

What’s Included?

01.

FUND YOUR FREEDOM FINANCIAL HUB

To give you one central location for your money plans so you can keep everything in an easy-access, easy-find location to stay committed to your financial journey.

02.

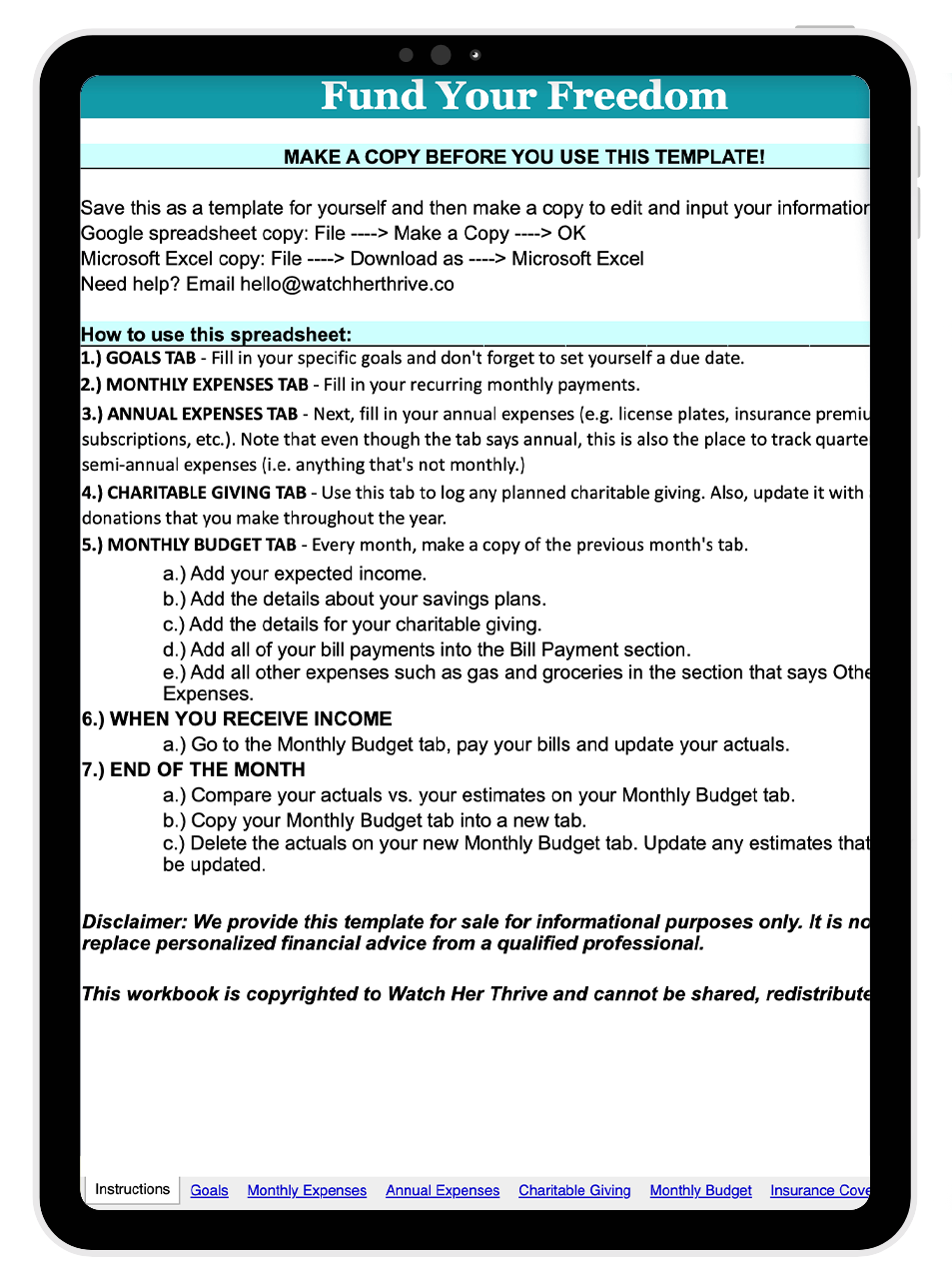

FUND YOUR FREEDOM WORKBOOK

Included in your financial hub is a 6-tab workbook to give you the hands-on tools you need to get absolute clarity about your money, what your goals are, where it’s going, and how to make it do what you want.

03.

BILL TRACKER & SPENDING PLAN

So you never again have to accidentally miss another payment or wonder if something has been already paid or is enrolled in autopay.

Also? “budget” is not what’s going to help you. You need a way to create an action plan for your money and that’s exactly what a spending plan - it gives your money a job and a connection to your goals.

Plus These Bonuses. . .

PAYCHECK READING GUIDE

Learn to read your paycheck so you can truly become Money Wise and understand where your money goes and what it does - including federal and state taxes and employer-sponsored insurance plans.

HOW TO LOWER YOUR MONTHLY GROCERY BUDGET MASTERCLASS

Grocery budgets are the most commonly overspent category of any spending plan. In this bite-sized masterclass, I’m going to give you actionable tips you can take to immediately lower your grocery bill to save for other goals.

CREATING YOUR EMERGENCY FUND

Having an emergency fund is a critical cornerstone of becoming MoneyWise. With an emergency fund, unexpected expenses -- like home repair or car fixes -- will no longer knock your financial plans off balance.

WHY ARE YOU SHARING THIS?

Hi, I’m Leah Hadley - financial advisor + money coach. I help regular people - non-millionaires, blue collar workers, white collar workers, nurses, teachers, government workers, and all sorts of ordinary folks like you and me - accomplish extraordinary goals by mastering their money.

You could say it’s my job to help people gain financial freedom.

It wasn’t always like that, though. After getting my master’s degree, I started work for a big investment firm and was appalled at the same ole cookie-cutter strategies being dolloped into everyone’s lap - regardless of their circumstance, goals, or financial situation.

On top of that, I saw how damaging that type of “guidance” (if you can call it that 🙄) was to the people that desperately needed solid financial advice. These same people were humiliated by these advisors for their lack of financial savviness - when that was the very premise of why they needed help in the first place.

I didn’t last long at the firm.

In fact, I’ve since made it my mission to help women and families reach their financial goals and it’s the reason why I’ve created this bundle.

Grab your copy now!

GET FUND YOUR FREEDOM FOR JUST $37

Fund Your Freedom Financial Hub (Valued at $47)

Fun Your Freedom Workbook (Valued at $47)

Bill Tracker (Valued at $17)

BONUS Paycheck Reading Guide (Valued at $17)

BONUS Everyday Expenses Training (Valued at $97)

BONUS Emergency Fund Guide & Tracker (Valued at $17)

Total Value = $242

Today’s Price = $37

Frequently Asked Questions

I'm *really* not good with money - I don't think this will work

Who told you that? Who told you that you were no good with money? Because someone did, in fact, tell you. (and maybe it was yourself?). Listen, there’s no such thing as being naturally gifted with money. Nobody is born knowing how finances work. It’s something you must learn. If you’re someone that believes you’re truly “not good with money” or have made bad financial decisions in the past - that’s not a reflection of your ability to manage money well. It’s simply a reflection of your need for a more tailored, simple way to LEARN money management. That’s exactly what Fund Your Freedom is.

What if I need more help than what this training can give me?

Fund Your Freedom money bundle is a fabulous way to start, but if you get through the training and are finding you’d still like more support - I’d love to talk about how I could support you in reaching your financial goals. You can visit WatchHerThrive.co or email me direct at hello@watchherthrive.co

How Do I Know Fund Your Freedom Will Work For Me?

Fund Your Freedom is meant to be a starter guide to financial literacy and awareness. I’ve created it with the beginner in mind and have tailored each lesson to really help you get started. This is the exact beginner framework I use with my VIP financial clients to help them on their road to becoming MoneyWise and now I’m giving it to you.

Can I buy it and get a refund?

Due to the digital nature of this bundle, there are no refunds. Also, out of principle to help you stick to your goals of becoming MoneyWise, I encourage you to complete the entire training.

What if I'm just not making enough?

Fair question, but one that is often misunderstood. What does it mean to “make enough?” Because about 89% of the time, the people I work with and those that’ve worked through this bundle find that they DO make enough, they just haven’t been optimizing their spending plan (or sticking to it) - putting them in a pattern of spending all their cash and forcing them into the paycheck-to-paycheck scarcity. The Emergency Fund bonus training will be exceptionally great for helping with this, but Fund Your Freedom included trainings are an amazing starting point to help you truly evaluate what you’re working with (and if you’re making enough).

DUE TO THE DIGITAL NATURE OF THIS TRAINING, THERE ARE NO REFUNDS.

FUND YOUR FREEDOM IS GOING TO HELP YOU:

understand your money + where it goes

gain control of your spending and patterns and

get downright clairvoyant about what’s coming so you won’t be caught off-guard with unexpected expenses.

GRAB YOUR COPY NOW - GET FUND YOUR FREEDOM FOR JUST $37

Fund Your Freedom Training (Valued at $47)

Fund Your Freedom Workbook (Valued at $47)

Bill Tracker (Valued at $17)

BONUS Paycheck Reading Guide (Valued at $17)

BONUS Everyday Expenses Training (Valued at $97)

BONUS Emergency Fund Guide & Tracker (Valued at $17)

Total Value = $242

Today’s Price = $37